Increase in VAT rates as of 01.01.2024, implement the changes in time

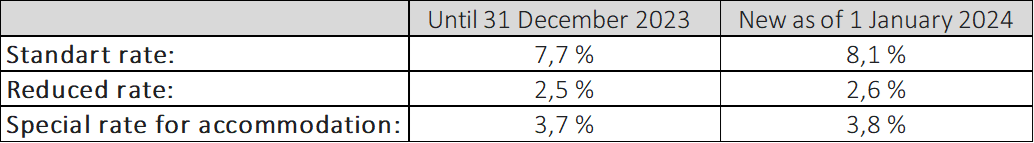

As of 01.01.2024, VAT rates will increase as follows:

This increase in the VAT rates is an effect of the AHV21 reform and serves to provide additional financing for the AHV and thus to safeguard the AHV until 2030.

Which date is now decisive for the VAT rate to be applied when invoicing? For VAT, the period of performance is decisive. This means that services and deliveries up to and including 31.12.2023 must still be invoiced at the previous rates. The services and deliveries from 01.01.2024 onwards must be considered with the new VAT rates when invoicing.

The new VAT rates can be used and declared for the first time in the VAT declaration from the 3rd quarter of 2023.

Titania Heimerl will be happy to advise you on this and help you implement the new rates.

+41 41 226 30 52

This email address is being protected from spambots. You need JavaScript enabled to view it.