In recent years, we have been used to receiving no or only a modest amount of interest on tax prepayments or paying interest on outstanding amounts. Due to the increase in interest rates, the federal government and most cantons will be reintroducing compensatory interest as of 2024.

This means that if you pay your taxes at the beginning of the year instead of the end, or if you pay more tax than necessary, you will receive compensatory interest. The interest is usually shown on the final tax bill and deducted from the tax payment. However, if you pay your taxes later or make too little tax prepayments, you may incur negative compensatory interest in certain cantons.

In addition to compensatory interest, late payment interest on overdue payments also will increase.

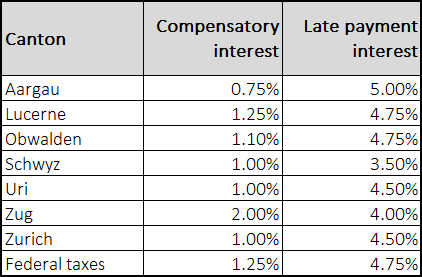

Below is an overview, valid from 01.01.2024:

It is therefore advisable to check whether sufficient tax has been paid in advance and, if necessary, to make further voluntary advance payments.

Reto Ottiger will be happy to advise you on this and help you calculate your tax liability.

+41 41 226 30 55

This email address is being protected from spambots. You need JavaScript enabled to view it.